As a concept, fair wealth investment uses the performance of enterprises based on fair wealth evaluation system as an important reference for investment.

Significance of fair wealth investment

Achieve higher investment returns for investors

For two reasons, higher return on investment is earned through fair wealth investment

- Fair wealth investment enterprises have lower investment risks (including laws and regulations, environment, resources, etc.)

- Fair wealth investment enterprises have higher development potential

Investments are better aligned with individual values (fair)

Through fair wealth investment, investments are better aligned with investors’ values, bringing spiritual fulfillment in addition to investment returns.

Investment creates more equitable social benefits and values, promoting fair development of society

Guided by fair wealth investment, well-performed enterprises are readily available for investment, thereby encouraging other enterprises to pay attention to the fair wealth, and ultimately stimulating the development throughout society.

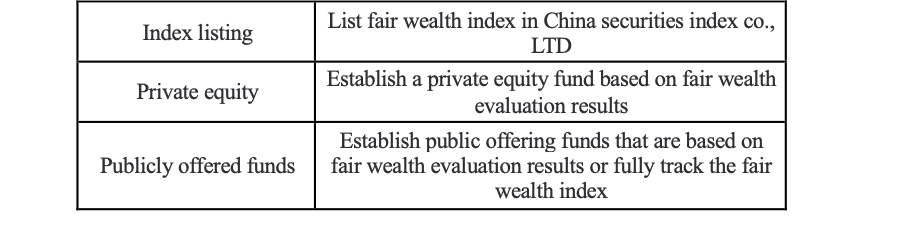

Specific forms of fair wealth investment

There are a total of four specific investment forms based on fair wealth: (1) taking fair wealth results as an investment reference factor, (2) using fair wealth results as a mandatory investment criterion, (3) investing according to fair wealth results, and (4) investing with the fair wealth index.

Investment reference factor

Investors factor into the fair wealth evaluation data among other reference factors when investing. For example:

They may refer to the star performance of the enterprise when investing.

They may consult specific manifestations of one or several dimensions and aspects of the enterprise in combination with the characteristics of industries.

Mandatory investment standard

Fair wealth evaluation data will be used as a mandatory screening criterion. Companies that do not meet such criteria will not be included in the scope of investment objects. For example:

There will be an absolute score criteria of aspects/dimensions/total points: enterprises with a score lower than that will not be considered for investment.

The relative pass criteria of aspects/dimensions/total points, i.e. they will only invest in the top few percent of enterprises.

Evaluation results investment

Investment objects are contained only in companies that are eligible for fair wealth evaluation, and invested in on that basis. Such as:

Select certain star/industry to invest in within the results-based range.

Follow their own investment strategies in star enterprises for optimization.

Index Investing

Investors make exponential investments based entirely on the fair wealth index.